Uh-oh! It’s payday, and you’re in a jam. It’s been a hectic month. Papers are all over the place and your email inbox is filled to the brim with spam. You somehow get all of the checks out, but the next day when you wake up exhausted, you swear to find a better way.

Fortunately, there is! With the onset of the internet, numerous programs have been created with the specific goal of helping small businesses organize their payrolls to make everyone happier.

We’ve put together a list, in no particular order, of the best payroll software programs out there for small businesses. They do vary in prices (from free to a bit pricey) and capabilities (from barebones to incredibly complex), depending on what you need. Let’s get to it!

-

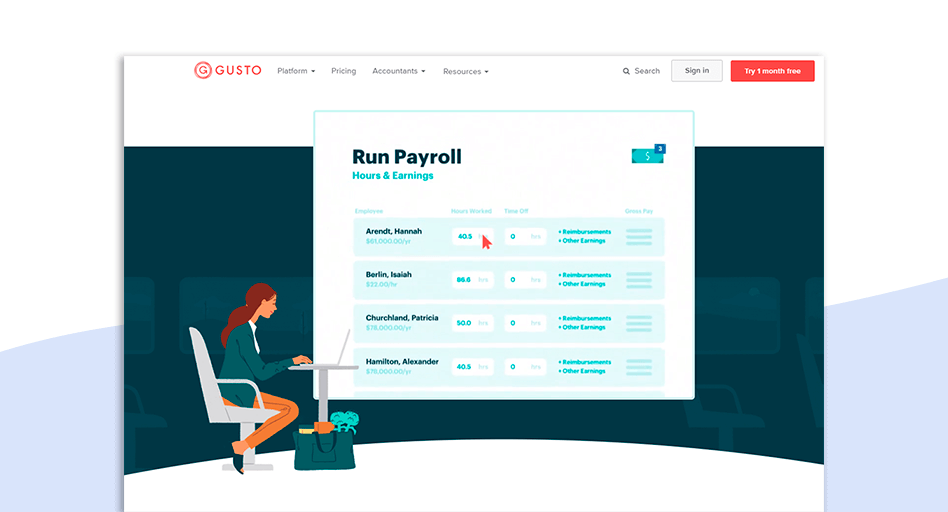

Gusto

https://go.gusto.com – Starts at $39

Though we consider all of the entrants on this list to be especially good, Gusto may be the best among equals. Renowned for its numerous capabilities, Gusto also won’t break the bank, coming in at $39 a month, plus an additional $6 for each employee. While it of course does your standard payroll processes, Gusto will also do your payroll taxes and will automatically fill out new-hire forms. It even has the ability to purchase employee healthcare and 401(k) plans in a click! Like all good programs, you can program Gusto to do everything automatically, so you can be sure your paychecks are going out on-time.

-

Collabrill

http://www.collabrill.com – Prices vary

One of Collabrill’s strongest points is its ease-of-use. It doesn’t take much to download and launch, and its ability to put your information into the cloud—therefore making it accessible from any device—is especially helpful for those who are on-the-go or who simply like to use multiple devices in rapid succession. For a system that’s typically just a couple bucks a month, it’s hard to beat.

-

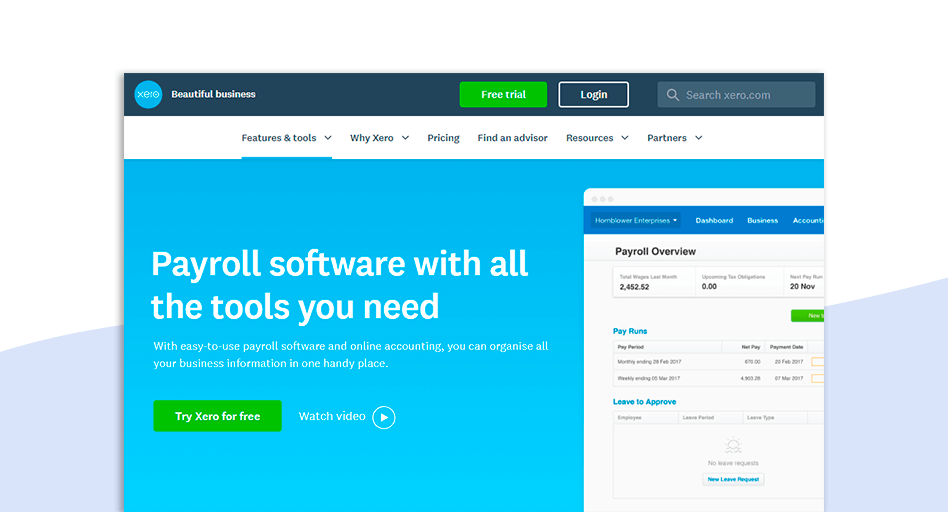

Xero Payroll

https://www.xero.com/accounting-software/payroll/ – Starter is $25 a month

Xero offers programs for a lot of different aspects of small business. Most are high-quality, and Xero Payroll is no exception. It’s chock full of useful little additions, such as reconciling up to 20 bank transactions and being able to set it to send your payment information to the HMRC. Xero users get the first month of any plan free, and the “Premium 5” plan—a not totally unreasonable $65 a month—also allows users to handle multiple currencies, which is a boon for businesses that deal internationally.

-

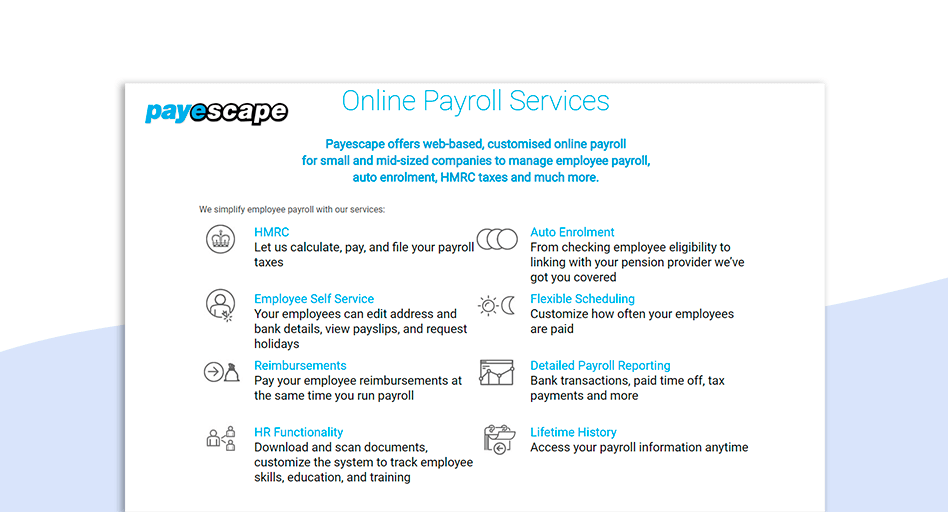

Payescape

https://www.payescape.com/payroll-services – Prices vary, a business with 10 people costs about $80

Payescape is on the higher end of our pricing spectrum. However, it’s got bang for its buck. Like Xero, Payescape offers HMRC payments, which will help file payroll taxes and make sure you don’t receive any uncomfortable IRS calls. Payescape also boasts “Employee Self Service”, the ability for your staffers to log in and edit their own personal information. If they change direct deposit accounts they don’t have to go through you to request a change- they can do it themselves! The same goes for requesting time off.

-

Paycheck Manager

https://www.paycheckmanager.com – 3 months free, other prices on the low end

Paycheck manager is definitely on the low end of pricing. While obviously this’ll take some strain off of your wallet, it also means it won’t have all the bells and whistles. Paycheck calculator is pretty straightforward: it calculates your paychecks and can print them out for you. Now this is great as it doesn’t require you to download anything (it’s basically just an online calculator), and because it’s an advanced calculator it lets you compute other things, like employee benefits. But again, it won’t do much more than that, so if you’re trying to organize your business more fully, you may want one of the other listings.