Ensuring compliance in call centers is now more crucial than ever. A wrong move can not only destroy your company’s reputation, but also result in excruciating fines. This article explores key aspects of call center compliance including the vital role customers play in compliance monitoring practices and how call centers manage the complex legal landscape. Understanding these elements can help companies maintain legal integrity and uphold customer trust.

What is call center compliance?

Compliance involves adhering to laws and regulations that govern how call centers operate. It ensures that all interactions between agents and clients meet legal requirements, protecting client rights and maintaining privacy. Regulatory compliance in a call center setting covers everything from how calls are recorded and monitored to how data is handled and stored. Adherence to these rules is not just about legal obligation; it also builds trust with customers, improving the contact center reputation and reducing the risk of penalties.

The evolution of call center compliance

Before the regulations

Initially, call centers operated without strict guidelines, focusing solely on customer service and sales. This lack of careful maintenance often led to inconsistent service quality and minimal accountability for security.

First steps towards an organized system

The first steps towards regulatory compliance involved implementing basic privacy protections and establishing guidelines for ethical communication and data handling:

- Introduction of TCPA (1991): The Telephone Consumer Protection Act was one of the first laws to address telemarketing abuses and the use of automated dialing systems.

- HIPAA (1996): The Health Insurance Portability and Accountability Act set a call center compliance standard for protecting medical details, impacting businesses handling personal details related to healthcare.

- PCI DSS (2004): The Payment Card Industry Data Security Standard mandated secure handling of credit card information by businesses, including call centers.

- GDPR (2018): The General Data Protection Regulation significantly improved security and privacy for all individuals within the European Union, affecting global calling operations.

2024 compliance regulations

TCPA

The Telephone Consumer Protection Act (TCPA) sets guidelines for telemarketing, focusing on the use of automated dialing systems, SMS texts, and ensuring proper consent and identification processes are in place. It mandates adherence to the National Do Not Call Registry and requires call center telemarketers to provide clear caller identification and opt-out mechanisms to protect privacy.

HIPAA

HIPAA, along with its amendments such as the HITECH Act, mandates rigorous practices to prevent unauthorized access to sensitive medical information and ensures the confidentiality of patient data.

Other key standards

- Gramm-Leach-Bliley Act (GLBA): Calls for financial institutions to protect financial information, ensuring privacy and safety in financial transactions.

- PCI DSS: Describes the requirements for secure customer service handling and storage of payment card information to prevent breaches and protect financial information.

- Fair Debt Collection Practices Act (FDCPA): Monitors compliance and governs the methods of debt collection to ensure practices are ethical and free from abuse or deception.

- Sarbanes-Oxley Act (SOX), Equal Credit Opportunity Act (ECOA), and Truth in Lending Act (TILA): These requirements focus on improving financial transparency, promoting non-discriminatory credit practices, and ensuring clear, accurate disclosure of credit terms to protect users and maintain market integrity.

- Recorded consent to be monitored: Stressing the need for obtaining explicit consent before recording calls, as mandated by TCPA, to ensure transparency and maintain trust between consumers and the call center.

Additional laws that may apply to your call center

- CAN-SPAM Act: This applies to companies that engage in email marketing. It sets requirements for commercial messages, gives recipients the right to have emails stopped from being sent to them, and spells out tough penalties for violations.

- Federal Trade Commission (FTC): Call centers must also comply with various FTC requirements that protect clients against unfair or deceptive business practices. This includes guidelines on advertising, marketing, and transactions.

- International laws: For companies operating internationally or dealing with international clients, additional regulations such as the UK’s Data Protection Act or Canada’s Anti-Spam Legislation (CASL) may also need to be considered.

Why is compliance so important?

- Protects from legal and financial penalties: Non-compliance can lead to hefty fines and legal actions from regulatory bodies.

- Enhances customer trust: Following security laws shows that a business and its customer service values customer privacy and security.

- Ensures fair business practices: Call center compliance with laws such as the ECOA ensures that all customers are treated fairly and without discrimination.

A call center ignoring TCPA requirements might face fines exceeding thousands of dollars per unauthorized contact, significantly impacting its financial stability.

Adhering to PCIDSS compliance standards reassures clients that their payment information is secure, thereby increasing their confidence in the contact center services.

Adhering to the ECOA rules prevents biases in credit decisions, ensuring all applicants are evaluated based on the same criteria, which promotes fairness and equality in lending.

How MightyCall can help?

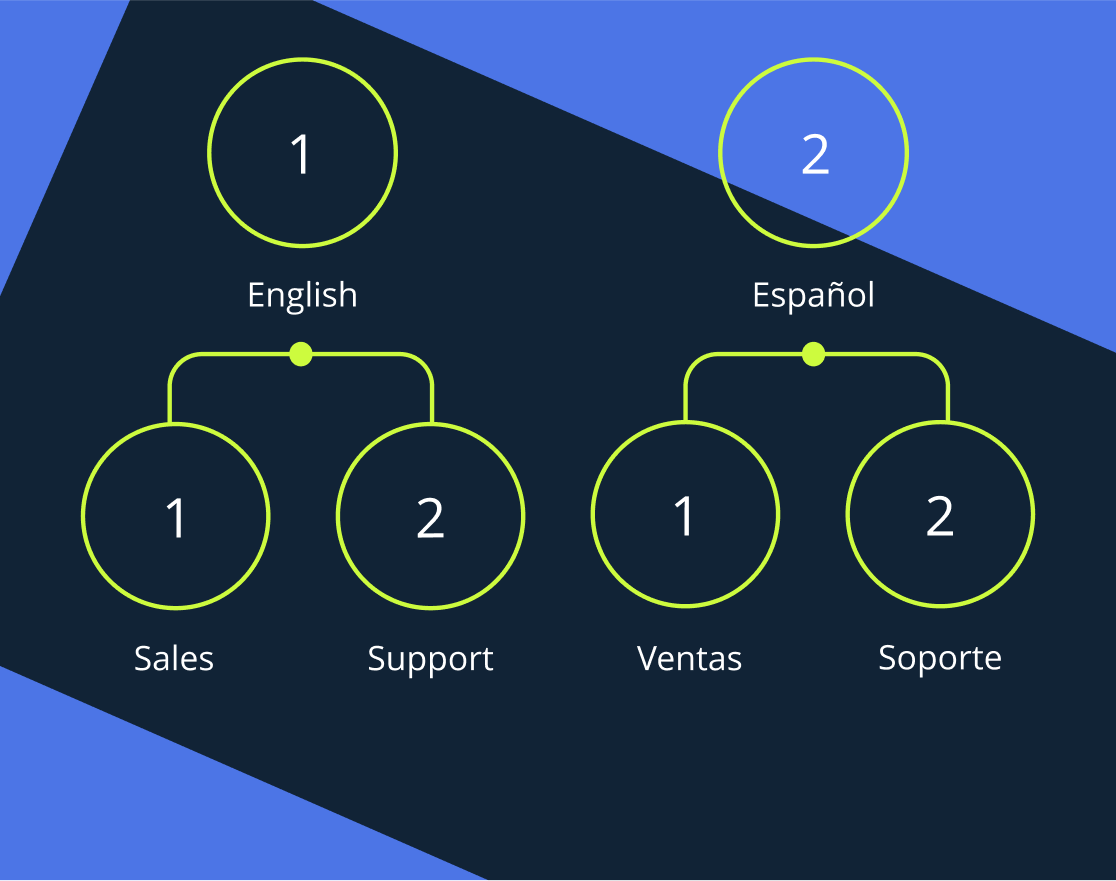

MightyCall is a cloud-based phone system designed to assist call centers in managing customer communications with features made to support:

- STIR/SHAKEN: MightyCall uses standards that certify the authenticity of caller ID information to prevent spoofing and fraudulent calls. This way, caller identities are verified, increasing trust and compliance in communication.

- Automated tools: MightyCall can automate certain aspects, such as DNC list management, ensuring that numbers on the registry are automatically excluded from call campaigns.

- Secure info handling: MightyCall adheres to industry-standard security protocols, helping ensure that sensitive customer data is handled securely in line with PCIDSS.

- Customizable call recording features: Call centers can configure call recording settings to comply with consent rules and ensure that recordings are managed as per legal requirements for call centers. The feature is also great for agent training.

- Detailed logging and reporting: MightyCall provides detailed call logs and reports, which can be crucial for audits and proving adherence to various regulations in call centers.

Consequences of non-compliance

- Financial penalties: Non-compliance can result in substantial fines from legal bodies, which can severely impact a contact center’s financial status.

ViSalus Inc. faced a staggering $925 million in damages for making more than 1.85 million unsolicited robocalls in violation of the TCPA regulations.

- Legal action: Violations of regulations such as HIPAA or TCPA may lead to lawsuits, including class actions, which can be costly and time-consuming to defend against, especially if your personnel wasn’t trained for it.

UCLA System agreed to pay $7.5 million to settle a class-action lawsuit after a breach exposed the personal and medical information of millions of individuals.

- Loss of trust: When clients learn that a call center did not follow the regulations and has mishandled their info or engaged in unethical practices, they may lose trust in that contact center or leading to customer attrition.

Facebook’s Cambridge Analytica scandal, where info from millions of Facebook users were improperly shared, breaking regulations, and leading to significant trust erosion and a sharp decline in user engagement.

- Operational disruptions: Addressing the center compliance issues often requires operational changes, which can disrupt business activities and lead to loss of productivity.

British Airways was fined £183 million for a breach that compromised personal details from 500,000 clients, leading to significant operational disruptions as the contact center scrambled to address the security issues.

Top strategies for playing it safe

Stay updated on legal changes

Maintain an ongoing understanding of all relevant laws for call centers. Better yet, get a qualified lawyer with experience in your industry. Regular agent coaching sessions and legal consultations are crucial to keep pace with changes in regulations for your center.

Implement informational safety

Prioritize service safety by employing encryption, secure access controls, and conducting regular audits. These measures protect your call center against data breaches and ensure contact center compliance with data protection laws.

Look for smart technology

Use call center technology that supports deference, such as automated DNC list management and secure recording. This helps integrate compliance into daily operations such as call center monitoring.

Document efforts

Keep detailed records of all compliance activities, including customer interactions, any contact, training materials, and audit results. Documentation is essential for call center monitoring and demonstrating compliance during audits and legal reviews. This is especially important if you work in debt collection.

Checklist: Assigning compliance responsibilities for contact centers

Feel free to refer to the following call center compliance checklist:

- Appoint an officer: Designate an individual responsible for overseeing all compliance activities and maintaining the legal communication standards.

- Define roles and responsibilities: Clearly specify each team member’s compliance duties and ensure they are aware of the applicable center compliance regulations.

- Schedule regular call center compliance training sessions: Establish ongoing training to keep staff updated on any legal changes.

- Implement compliance monitoring tools: Use technology to assist in maintaining compliance.

- Document compliance efforts: Keep detailed records of all compliance-related activities and communication.

- Plan for emergency issues: Be ready. Call centers should always have prepared protocols for handling potential breaches.

What are the industry standards for call center compliance?

Here are some of the key industries and their major monitoring compliance concerns (and potential areas for your agents to get trained):

Real estate

- TCPA and DNC Regulations: Critical for real estate agents making cold calls or sending messages, requiring adherence to opt-out requests and other telemarketing call center compliance regulations.

- Fair Housing Act (FHA): Ensures that all center communications, advertisements, and interactions do not discriminate based on race, color, national origin, religion, sex, familial status, or handicap.

- Data Security Laws: Protects personal and financial information of customers, especially during transactions and calls that involve sensitive data.

Healthcare

- HIPAA (Health Insurance Portability and Accountability Act): Ensures the protection of patient health information, requiring strict safety maintenance measures and confidentiality.

- HITECH: Expands HIPAA regulations, particularly in technology use, increasing the penalties for medical data breaches.

- Patient Consent: Call centers must obtain and document explicit consent before discussing personal health information.

Financial services

- GLBA (Gramm-Leach-Bliley Act): Mandates that financial institutions protect the privacy of clients’ financial information.

- PCIDSS: Requires secure handling and processing of credit card information to prevent fraud and breaches.

- Dodd-Frank Act: Imposes restrictions on certain financial practices and protections, affecting how financial products are sold over the phone contacts.

Telecommunications

- TCPA: Regulates telemarketing activities, including the use of calls, auto dialers, and pre-recorded messages, and enforces the DNC (Do Not Call) registry.

- CPNI (Customer Proprietary Network Information) Regulations: Protects customer data generated during the course of providing telecommunications services.

- Net Neutrality Concerns: While primarily a legal framework, adherence impacts how a service is explained and offered to clients.

Retail and E-commerce

- Data Protection Laws (like GDPR for EU clients): Ensure the safety of personal data and allow consumers to control their information’s use, especially relevant in cross-border transactions.

- Consumer Rights Laws: Vary by region but generally involve clear communication about return, refund, and warranty policies, which is also very important for all call centers.

- PCIDSS: Specifically crucial for call centers handling transactions to secure payment data against breaches.

Ensure call center compliance

All call center compliance regulations are just humane and ethical practices most humans would like to have when it concerns their rights. As a call center owner, you should ask yourself how something your call center does would affect an individual. Ultimately, being compliant is just about eliminating potential negative consequences for yourself, your customers, and your contact center.